A Comprehensive Guide to Finance and Insurance

We adopt a catchphrase. Reliable financial experts never go out of style. because experts are handling substantial sums of money while carrying personal liabilities.

The slogan “Building a Solid Financial Foundation for a Secure Future” is memorable.

Establish a solid foundation for individual and business success by learning the fundamentals of finance and insurance.

Key Points: Understand the principles of risk management, investing, and budgeting to bolster financial stability and guard against unforeseen challenges.

What is Finance?

According to Mr. Thomas L. Bean’s book Corporate Study of Finance, which was published in 1897, the term finance originated in the second half of the 19th century and was borrowed from the Latin language Finnish. Ever since, financial education has been offered as a stand-alone course. Money management is the task of finance. Finance is the practice and discipline of handling money. It is quite simple to say that I spent the entire day here every morning after leaving with my father’s $100 pocket money.

I took my dad’s money. This is the process of collecting funds, or money. Who works nonstop and throughout the entire day? To handle or spend money is the essence of it.

If we explain straightforward , The study of finance focuses on how people, organizations, and governments handle money. It entails comprehending the movement of money into and out of different organizations as well as how it is distributed among various purposes, including savings, spending, and investments. To put it simply, finance is the study of financial decision-making, such as how much money to save, spend, and invest in order to reach one’s financial objectives. So Maximization of wealth is the primary goal of finance.

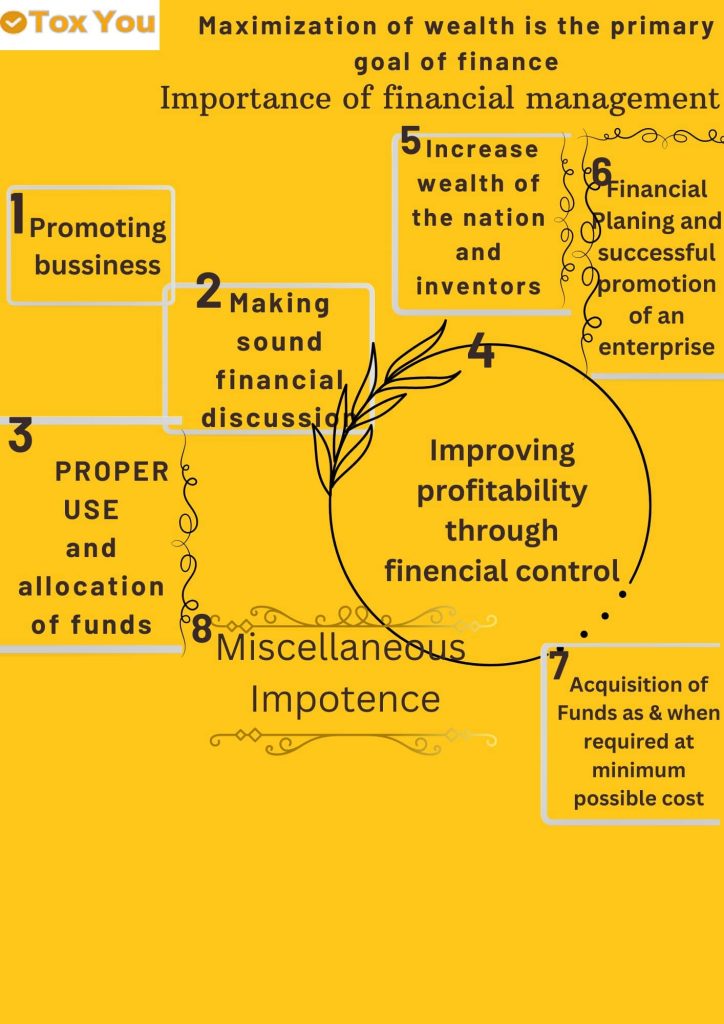

Importance of financial management

The practice of methodically allocating, managing, organizing, and supervising financial resources in order to accomplish goals is known as financial management. Its goals are to increase income, decrease risk, promote sustainable growth, and increase productivity. Included are cash flow management, capital allocation, risk management, budgeting, and strategic planning.

A Synopsis of Money Management

• Managing and supervising the use of financial resources in order to accomplish objectives.

• Making efficient use of resources to increase profitability and reduce financial risk.

• Promoting long-term sustainable development.

Budgeting, investment research, and risk management are a few of the strategies.

• Financial stability and maximum shareholder value are attained through cash flow management, capital allocation, and strategic planning.

• Supports individuals and organizations in navigating complex economic situations by helping them maximize opportunities and preserve financial stability.

3. Role of finance in personal and business settings

Personal Finance Overview

• Facilitates budgeting for savings and discretionary expenditure.

• Offers opportunities for long-term financial security and retirement planning.

• Assists in managing and repaying obligations, reducing interest payments and maintaining positive credit.

• Enables setting and meeting financial goals like home purchase, education, and vacations.

Now we need to know what business finance is. Let’s say I want to start a grocery store business. I need $10 million; I have $5 million; and I borrowed another $5 million from the bank. Now that I started the business, I paid the rent, paid the municipal tax, bought the goods, bought the furniture, and paid all the expenses. At the end of the year, I saw that my profit was one lac and twenty thousand dollars. From the dividend, I used twenty thousand dollars for my own work and the remaining one thousand dollars for business expansion or maintenance. We can refer to this whole activity as business finance.

- First I planned, like I would give a grocery store, then I identified the source, like I would give five lacs of money from myself and five lacs of money I would borrow from the bank. We raised the funds.

- Investing funds or using our money behind the grocery store. Then I saved some of the profit from there. At the end of this, I used and spent the profit distribution, or my own money, on my own work or project.

Setting for Business:

Capital Management:

• Facilitates efficient acquisition, distribution, and use of capital.

• Guarantees optimal resource utilization for operations, growth, and innovation.

Risk Management:

• Protects companies from losses by recognizing, evaluating, and reducing financial risks.

Strategic Decision-Making:

• Aids in pricing strategies, resource allocation, and investment opportunities.

Performance Evaluation:

• Monitors and assesses company’s performance using financial indicators.

• Informs management choices and enables necessary course corrections.

Several forms of finance are available to meet the needs of both individuals and businesses:

Personal Financing Options: a. Personal Loans: Taking out a loan from a financial institution for a predetermined sum of money with set terms for repayment.

a. Credit Cards: These are revolving credit lines that let customers borrow money and pay it back gradually, up to a predetermined amount.

c. property equity loans: These loans use the equity that has grown in a property as security for a variety of purposes.

d. Peer-to-peer lending: direct loans made via internet platforms to people, usually at affordable interest rates.

e. Loans from Retirement Accounts: Borrowing with specified payback terms secured against the balance of a retirement account, like an IRA or 401(k),.

Business Financing Options

• Debt Financing: Loans with principal plus interest repayment.

• Equity Financing: Offers investors ownership shares without payback obligations.

• Venture Capital: Funds entrepreneurs with growth potential in exchange for shares.

• Angel Investment: Capital provided in return for convertible debt or ownership shares.

• Crowd funding: Uses internet platforms to raise funds in exchange for incentives, debt, or stock.

• Grants and Subsidies: Non-repayable financial contributions to initiatives.

• Trade credit: Enables businesses to purchase goods or services with postponed payment.

Understanding Different Loan Types

Personal Loans:

• Unsecured credit for personal uses like debt consolidation, home renovations, and medical payments.

• Set repayment and interest rates.

Mortgages:

• Loans for buying real estate, with flexible repayment terms.

• Interest rates can be variable or fixed.

Auto Loans:

• Loans for car purchases, unsecured or secured by the car.

• Interest rates and repayment terms vary.

Student Loans:

• Loans for higher education costs.

• Options for deferred payments.

• Various terms and interest rates.

Payday Loans:

• High-interest, short-term loans covering costs until next paycheck.

• Exorbitant fees and interest rates.

Home Equity Loans:

• Loans against property value, usually with fixed interest rate and repayment period.

• Loan usually secured by the house.

Credit Lines:

• Flexible borrowing option up to pre-established credit limit.

• Can have varied security measures and/or insecure interest rates.

Business Loans:

• Financing for expansion plans, equipment acquisitions, and starting fees.

• Can have fixed or variable interest rates, and can be secured or unsecured.

Exploring credit cards and their uses:

Credit cards offer users convenience, flexibility, and numerous benefits, making them crucial in today’s financial landscape. They facilitate various expenses, from regular purchases to unexpected bills, making them a simple and efficient payment method.

1. Easy Payment Method: Using a credit card makes it easy to make purchases online and in stores. Customers may swiftly and securely make transactions with just a swipe or tap, doing away with the need to carry cash or write checks. This ease of use also applies to traveling abroad, where credit cards are commonly accepted, making currency exchange easier and lowering the danger of carrying large amounts of cash.

2. Establishing and Developing Credit History: People can create and develop their credit history by using credit cards responsibly. Credit ratings are positively impacted by prompt payments and a low credit utilization ratio, which show credit bureaus that a borrower is financially responsible. To be eligible for future advantageous terms on loans, mortgages, and other credit, one must have a solid credit history.

3. Emergency Funds: Credit cards can be a very helpful tool in case of crises or unforeseen costs. Having a credit card with an available credit limit offers a safety net to cover unforeseen expenses, such as house repairs, auto repairs, or medical expenditures. To prevent accruing debt, it’s crucial to utilize credit sensibly and only for essential costs.

4. Perks and Rewards: A lot of credit cards come with reward schemes that let customers accrue miles, points, or cashback for their transactions. Cardholders can obtain extra value by redeeming these rewards for merchandise, gift cards, travel, or statement credits. To further improve the customer experience, certain credit cards come with extra benefits like access to airport lounges, extended warranties, and travel insurance.

5. Budgeting and Expense Tracking: Credit card statements offer thorough records of transactions, which simplify the process for people to keep tabs on their out-of-pocket costs and budget. In order to help consumers maintain organization and financial discipline, a number of credit card issuers provide mobile apps and online account management tools. These tools let users classify expenses, set spending alerts, and monitor transactions in real-time.

6. Interest-Free Period: The majority of credit cards come with an interest-free grace period, usually lasting between 21 and 25 days, that allows users to pay off their whole debt without incurring interest. Since there is no interest during this time, consumers can effectively use it as short-term financing by deferring payment until their subsequent billing cycle without facing further fees. Enhanced security features for online shopping, like fraud prevention, zero-liability rules, and purchase protection, are available with credit cards. Unauthorized charges are not the cardholder’s responsibility, and a lot of issuers protect important data with sophisticated authentication and encryption techniques, which lowers the possibility of fraud and identity theft.

7. Credit Card Benefits: Credit cards frequently offer extra benefits like roadside assistance, concierge services, and rental car insurance in addition to points and perks. These extra perks raise the credit card’s total value proposition and give users ease and peace of mind when they travel or make large purchases.

In summary, credit cards are adaptable financial instruments that provide customers with ease, flexibility, and a number of advantages. Making routine transactions easier In addition to establishing credit, giving rewards, and supplying emergency cash, credit cards have other uses in contemporary money management. However, to fully take advantage of credit card benefits while avoiding dangers, it’s imperative to use credit responsibly, pay balances in full and on time, and avoid accruing excessive debt. People can make selections that suit their requirements and financial objectives by being aware of the features and advantages of credit cards.

Overview of investment options

A Synopsis of Investing Choices: Recognizing Your Financial Possibilities

Investing is a vital part of financial planning because it enables people to reach their long-term financial objectives and increase their wealth over time. For both novice and seasoned investors, researching the plethora of investing possibilities can be intimidating. To make well-informed decisions that fit your financial condition, investing objectives, and risk tolerance, it is imperative to have a thorough understanding of the different investment vehicles that are accessible. Now let’s examine a few of the most popular investing choices:

1. Stocks: In publicly traded corporations, stocks are a representation of ownership. Upon purchasing stock, you become a shareholder and gain an interest in the success and earnings of the business. Although stocks have a high return potential, there is a higher level of risk and volatility associated with them. Putting money into individual In order to find prospective firms and successfully manage investment risk, stocks demand study and analysis.

2. Bonds: To raise money, governments, towns, or businesses may issue bonds, which are debt securities. Purchasing a bond means effectively lending the issuer money in return for regular interest payments and the principal amount being returned when the bond matures. Bonds are a good option for conservative investors looking to preserve money and achieve predictable returns because they are generally seen as having less risk than equities and offering consistent income.

3. Mutual Funds: To invest in a diverse portfolio of stocks, bonds, and other securities, mutual funds pool the money of several participants. Expert fund managers handle investments in mutual funds, selecting investments in accordance with the goals and strategy of the fund. Diversification is provided by mutual funds. They appeal to investors with different risk profiles and investment objectives because of their liquidity and expert management.

4. Exchange-Traded Funds (ETFs): ETFs trade on stock markets like individual equities, but they resemble mutual funds. ETFs give investors access to a diverse range of securities through a single investment instrument by tracking particular market indices, industries, commodities, or asset classes. ETFs are well-liked by investors looking for broad market exposure with more liquidity and transparency because of their flexibility, cheap fees, and tax effectiveness.

5. Real Estate: Buying properties, such as houses, businesses, or land, with the hope of eventually seeing capital growth and/or rental income is known as real estate investing. In addition to providing benefits for diversity, real estate acts as an inflation hedge. Real estate investment trusts (REITs), which trade on stock exchanges and invest in income-generating real estate properties, allow investors to make indirect investments in real estate as well as direct ones.

6. Retirement Accounts: Retirement accounts provide tax-advantaged savings and investment choices for retirement planning. Examples of these accounts are 401(k)s, IRAs, and Roth IRAs. With these accounts, people can invest in equities, bonds, mutual funds, exchange-traded funds (ETFs), and other assets and take advantage of tax advantages like tax-deferred growth or tax-free withdrawals during retirement. Long-term wealth creation and retirement security depend on making the most of contributions to retirement funds.

7. Alternative Investments: Alternative investments comprise assets like hedge funds, private equity, commodities, and crypto currencies in addition to conventional stocks, bonds, and cash. Alternative investments provide the potential for greater returns and the benefits of diversity, but they also come with more expensive fees, illiquidity, and complexity. Before adding alternative investments to their investing portfolios, investors should thoroughly assess them and take their risk-return profile into account.

8. Certificates of Deposit (CDs) and savings accounts: Although they are not conventional investment vehicles, CDs and savings accounts offer a liquid and secure option to earn interest on cash reserves. While CDs offer greater interest rates in exchange for locking in cash for a predetermined length of time, savings accounts provide instant access to funds and FDIC insurance protection. These choices might yield lesser returns than other investment options, but they are appropriate for emergency cash and short-term savings objectives.

To sum up, there are many different investment possibilities, each with unique traits, dangers, and possible gains. A variety of asset classes are diversified, and in order to achieve long-term financial success, it is important to understand your investment options and adopt a disciplined approach to investing. Working with a financial advisor can provide you with personalized guidance and assistance in navigating the complexities of investing. Investing in vehicles is essential to building a well-rounded portfolio that matches your financial goals and risk tolerance.

Financial Planning

The systematic process of managing finances to accomplish particular objectives and safeguard one’s financial future is known as financial planning. It entails evaluating one’s existing financial situation, establishing quantifiable goals, making a budget, controlling debt, saving, investing, and making retirement plans. Understanding income, costs, assets, and obligations can help people create a detailed strategy for wise resource allocation and stable finances. Risk management, which includes emergency insurance coverage and defense against unanticipated catastrophes, is another aspect of financial planning. The plan is reviewed and adjusted on a regular basis to ensure that it remains aligned with evolving economic and personal situations. In the end, financial planning gives people the ability to prioritize their financial objectives, make well-informed decisions, and create a road map for long-term financial security and prosperity.

Budgeting Importance and Benefits

• Essential for financial health as it provides a roadmap for income and expense management.

• Assists in setting spending priorities, monitoring financial expenditures, and making future financial plans.

• Helps in saving money, cutting debt, and preventing overspending.

• Encourages financial discipline, enabling wise resource management and informed decisions.

• Lessens financial stress and worry by enabling better planning for unforeseen costs and emergencies.

• Provides the groundwork for long-term success and financial security.

Tips for saving and investing

Establish Specific Savings and Investing Goals: Establish clear financial goals, such as home ownership, college funding, or retirement. For instance, set a goal to save 20% of your monthly income in the following five years to use as a down payment on a home. Establish a Budget: Monitor earnings and outlays to pinpoint opportunities for cost savings. Set aside a certain percentage of your monthly income for investments and savings.

Set aside $200 a month, for example, for emergency savings or retirement contributions. Automate Savings: You can program automatic transfers to savings or investment accounts from your checking account. This guarantees steady donations, free from the need to overspend. For example, set up a direct transfer of a percentage of your pay into an investment portfolio or retirement account. Investing Diversification: Spread investments made in a variety of asset sectors, including bonds, real estate, and equities, to reduce risk. For diverse market exposure, think about investing in exchange-traded funds (ETFs) or mutual funds.

Benefits from Employer Benefits: Make contributions to retirement plans offered by your company, like a 403(b) or 401(k), particularly if the employer is matching the funds. To optimize retirement savings, make a sufficient contribution to optimize the company match. To fully benefit from a match, for instance, make sure you contribute at least 5% of your salary if your company matches contributions up to that amount. Educate yourself: To make wise judgments, familiarize yourself with the various investment possibilities and strategies.

Think about educating yourself using books, going to seminars, or speaking with a financial counselor. Investigate possible investments and be aware of the dangers and rewards that could be obtained before supplying money. Monitor and Modify: Make sure your investing and savings strategy is in line with your risk tolerance and goals by reviewing it on a regular basis.

As your financial status or the state of the market changes, make the necessary adjustments to your contributions or investment allocations. By using these pointers, people can establish sound investment and saving practices, work toward their financial objectives, and gradually accumulate money.

Financial Goal Setting Process

• Establish clear, quantifiable financial objectives.

• Divide ambitious goals into manageable ones with due dates.

• Create a budget to track earnings and expenses.

• Automate savings for regular contributions.

• Regularly analyze finances for progress tracking and necessary adjustments.

• Maintain discipline by sticking to budget and avoiding impulsive purchases

II. Insurance Basics

Insurance: Safeguarding Your Prospects

Insurance is an essential aspect of financial planning, pivotal in safeguarding against unforeseen circumstances that can have significant financial implications. It’s a protective shield for individuals, families, and businesses, designed to provide peace of mind and stability when life throws a curveball.

The Essence of Insurance

At its core, insurance is a contract, typically known as a policy, between an individual or entity and an insurance company. This contract stipulates that the insured pays a premium—a regular amount of money—in exchange for the insurer’s promise to compensate for certain losses, damages, injuries, or death.

Types of Insurance

There are various types of insurance, each tailored to protect different aspects of our lives and assets:

- Health Insurance: Covers medical expenses for illnesses, injuries, and preventive healthcare. Given the high cost of medical care, health insurance is vital for maintaining your wellbeing and protecting your finances from exorbitant medical bills.

- Life Insurance: Provides monetary benefit to a designated beneficiary upon the insured person’s death. It is crucial for those who support financial dependents, ensuring their financial well-being even in one’s absence.

- Auto Insurance: Mandatory in many jurisdictions, it covers vehicles against accidents, theft, and other perils. Auto insurance not only protects one’s car but also provides liability coverage for bodily injuries or property damage caused by the insured.

- Homeowners/Renters Insurance: Protects your residence and possessions within it. Homeowners insurance covers the structure and contents against disasters like fire, theft, and natural calamities, while renters insurance focuses on insuring personal property within a rented dwelling.

- Disability Insurance: Offers income replacement if you’re unable to work due to disability resulting from illness or injury. This type of insurance is key to ensuring continuous income flow during difficult times.

- Liability Insurance: Safeguards against legal liabilities to third parties—when one is responsible for injury or damage to another person or their property. This insurance is critical for both individuals and businesses.

How Insurance Works

At the outset, insurance might seem complex, but its underlying principle is quite straightforward: risk-sharing. When you purchase a policy, your premiums are pooled with those of many other policyholders. The insurance company uses this pool of funds to pay out claims as they arise.

Premium amounts are determined by several factors, such as the type of coverage, the likelihood of filing a claim (risk), the value of the insured entity, and your personal details (like age or health status). Higher risks often lead to higher premiums.

Deductibles and Policy Limits

Understanding deductibles and policy limits is crucial to selecting the right insurance plan. A deductible is the amount you must pay out-of-pocket before the insurance kicks in. Typically, a higher deductible results in a lower premium because you’re assuming more financial responsibility.

A policy limit is the maximum amount an insurer will pay under a policy for a covered loss. Limits can be set per period (e.g., annual), per loss or injury, or over the life of the policy, known as the lifetime maximum.

The Benefits of Being Insured

The most obvious benefit of insurance is financial protection. If an incident occurs, you could face substantial costs that could deplete your savings or even push you into debt. With insurance, these costs become more manageable.

But beyond the financial aspect, insurance can offer:

- Peace of Mind: Knowing that you, your loved ones, and your assets are protected can reduce stress and worry.

- Risk Management: Especially for businesses, insurance is a key component in managing risks and providing stability for operational continuity.

- Incentives for Good Behavior: Many insurers offer discounts or rewards for good behavior, such as safe driving or a healthy lifestyle, which can promote and incentivize responsible actions.

Choosing the Right Insurance

Selecting the appropriate insurance involves assessing your individual needs and considering various factors:

- Coverage Needs: Consider what you need to protect and the potential risks you face.

- Budget Constraints: Determine what you can afford without putting undue strain on your finances.

- Insurance Provider: Choose a reputable company with a history of reliability and customer satisfaction.

- Terms of the Policy: Read the fine print to understand what’s covered, what’s not, and what the terms of settlement involve.

Conclusion

Insurance should not be an afterthought; rather, it should form a part of your proactive financial strategy. Whether it’s for personal or professional purposes, having the right insurance coverage ensures that you’re prepared for whatever life throws at you. Remember, the goal of insurance is not to make one rich but to prevent one from becoming poor as a result of an unexpected loss. Crafting a safety net with a mix of insurance policies is a step toward a secure and worry-free future.

FAQs:

Question: Why is financial planning important?

Setting specific financial objectives, controlling income and expenses, and reducing risks all depend on sound financial planning. It helps people to save for emergencies or retirement, invest sensibly, and create an effective budget. Taxes can be optimized, debt can be reduced, and assets can be protected with estate and insurance planning. In the end, financial planning gives people the confidence and security to pursue their long-term goals, make educated decisions, and attain financial stability. Financial planning helps individuals establish goals, create a roadmap for their financial future, and make informed decisions about saving and investing.

Question: How can I choose the right insurance policy?

Evaluate your demands, taking into account things like age, health, dependents, and financial responsibilities, to select the best insurance plan. Compare coverage, premiums, deductibles, and exclusions when researching different policies. Assess the standing and soundness of the insurance companies’ finances. Use internet resources or the counsel of dependable experts to learn about the meaning and consequences of policy words. Consider bundling policies for potential discounts. Make sure the policy documents match your needs and budget by carefully reviewing them. Review your coverage frequently to adjust for changes in your life. In the end, give top priority to comprehensive coverage that fits within your budgetary constraints and provides sufficient protection against potential dangers.

When selecting insurance coverage, consider your needs, budget, and risk tolerance. It’s also important to review policies regularly to ensure they align with your current situation?

Take your needs, spending limit, and risk tolerance into account when choosing an insurance plan. Consider things like your age, health, dependents, and financial commitments. Compare coverage, premiums, deductibles, and exclusions when researching different policies. Assess the standing and soundness of the insurance companies’ finances. Use internet resources or the counsel of dependable experts to learn about the meaning and consequences of policy words. Review your coverage frequently to adjust for changes in your life. Give top priority to comprehensive coverage that fits within your budgetary constraints and provides sufficient protection against potential dangers. You can make sure that your insurance coverage is still appropriate and useful for your current circumstances by taking these things into account and routinely checking your policies.

Question: What are some common financial pitfalls to avoid?

Avoid common financial errors including living over your means, not saving for emergencies or retirement, taking on high-interest debt, and not sticking to an effective budget. Furthermore, investing without adequate knowledge or investigation can result in losses. You risk being under insured or paying for superfluous coverage if you disregard the necessity for insurance or neglect to evaluate your policy on a regular basis. Long-term financial objectives can also be harmed by emotionally driven decisions, such as panic selling in times of market weakness. To avoid these traps and keep a solid financial foundation, it’s imperative to place a high priority on financial literacy, consult reliable sources for guidance, and review your financial plan on a regular basis.

Common financial pitfalls include overspending, taking on too much debt, and neglecting to save for emergencies or retirement. By practicing good financial habits and seeking professional advice when needed, individuals can avoid these pitfalls and achieve financial stability.

Tox You It's all about earning solutions, News, Entertainment

Tox You It's all about earning solutions, News, Entertainment